How NiFi Powers Real-Time Risk Scoring and Customer Data Unification in Banking

![]()

Modern banking is data-driven, but as banks expand their digital services, they’re also dealing with an explosion of disparate systems – core banking, CRM, loan origination, mobile apps, third-party credit systems, and more. This fragmentation poses two critical challenges: maintaining a real-time understanding of customer risk and achieving a unified customer profile across systems.

To meet regulatory expectations, prevent fraud, and deliver fast, personalized services, banks need a platform that can ingest, transform, and route data in real time. Apache NiFi, with its visual flow-based programming, robust connectors, and real-time capabilities, has emerged as a key enabler in this transformation.

This blog explores how Apache NiFi in Banking enables real-time risk scoring and customer data unification. Also, it introduces a game-changing companion for NiFi, Data Flow Manager, which extends its capabilities and helps businesses achieve operational excellence.

The Need for Real-Time Risk Scoring in Banking

Banks face growing pressure to assess risk instantly. Whether it’s evaluating a loan application, detecting a suspicious transaction, or scoring a new customer’s creditworthiness, timing is everything.

Traditional vs. Real-Time Scoring

- Traditional Risk Scoring often relies on batch processing, with decisions made hours or even days after the data is collected.

- Real-Time Scoring enables immediate decision-making at the point of interaction, improving customer experience and reducing exposure to risk.

Key Use Cases of Risk Scoring in Banks

- Loan Approvals: Assessing creditworthiness on the fly during digital applications.

- Fraud Detection: Spotting anomalies in real-time to flag or block transactions.

- KYC/AML Monitoring: Continuously evaluating customer behavior against compliance rules.

- Transaction Risk Assessment: Scoring transactions based on amount, location, device, and historical behavior.

The Challenge of Customer Data Unification

While banks collect rich data across their customer touchpoints, this data typically resides in silos:

- CRM holds contact history

- Core banking holds transaction history

- KYC systems hold identity documentation

- Mobile apps capture behavioral insights

The result? An incomplete and inconsistent view of the customer. This not only limits personalization but also weakens risk models and compliance efforts.

Unifying this data into a “golden customer profile” is essential for both operational efficiency and risk mitigation, but it requires seamless integration across legacy and modern systems, with real-time updates.

Why Apache NiFi?

Apache NiFi is a powerful data integration tool designed to automate the flow of data between systems, in real time, with full observability and control.

Key Capabilities:

- Drag-and-Drop Flow Design: Create and modify complex pipelines visually.

- Real-Time Processing: Process streaming data with millisecond latency.

- Built-in Connectors: Connect to databases, APIs, Kafka, HDFS, S3, and more.

- Data Routing & Prioritization: Route data based on content, source, or schema.

- Security & Governance: SSL, access control, provenance tracking, and version control (via NiFi Registry).

With these features, NiFi becomes the backbone for unifying and processing data in real time, ideal for use cases in modern banking.

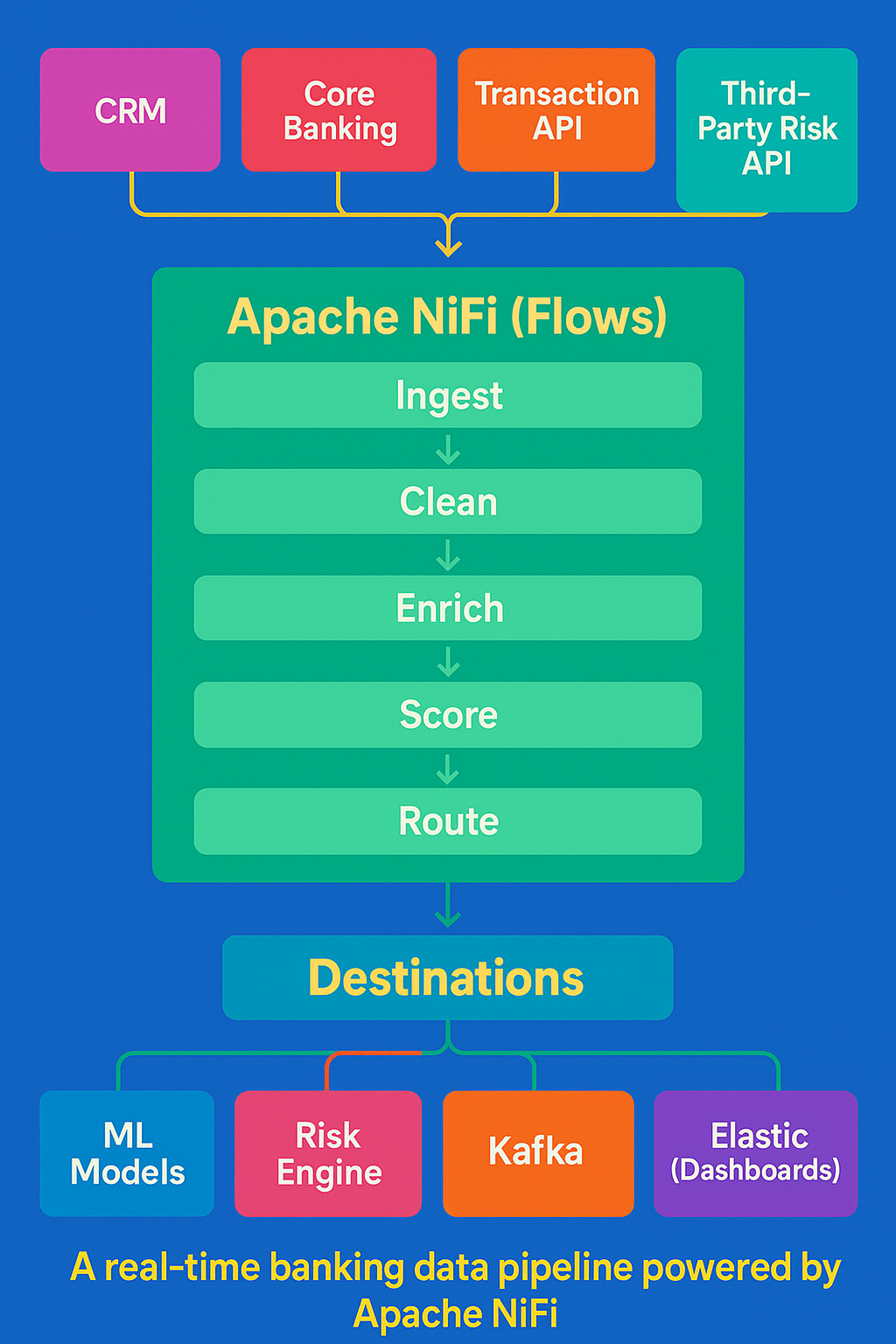

NiFi for Real-Time Risk Scoring

Using NiFi, banks can build pipelines that:

- Ingest real-time data: Pull in data from transaction logs, credit bureaus, third-party risk platforms, and internal systems.

- Transform and enrich data on the fly: Add geolocation, transaction context, customer segment, etc.

- Trigger scoring engines: Route enriched data to internal AI/ML models or external scoring APIs.

- Take action: Automatically flag risky behavior, generate alerts, or auto-approve low-risk applications.

For example, a suspicious credit card transaction can be evaluated based on location, amount, time, and historical behavior within seconds. NiFi ensures this pipeline is monitored, auditable, and scalable.

NiFi for Customer Data Unification

NiFi is equally powerful when it comes to merging fragmented customer data into unified records:

- Cross-System Ingestion: Pull data from CRM, core banking, call center logs, and digital channels.

- Data Cleansing & Deduplication: Normalize fields (e.g., names, addresses), detect duplicates, and resolve inconsistencies.

- Enrichment: Enhance records using third-party data or internal models.

- Storage & Synchronization: Push unified profiles to a centralized data lake, analytics platform, or real-time dashboard.

With flow versioning via NiFi Registry and data lineage tracking, banks can maintain full audit trails, an essential feature for regulatory reporting.

Benefits of Apache NiFi for Banks

Adopting NiFi for real-time data processing and customer unification delivers measurable benefits:

- Faster, Smarter Decisions: Instant insight at every customer interaction.

- Reduced Fraud and Risk: Continuous evaluation of risk across touchpoints.

- Regulatory Readiness: Full auditability and compliance with KYC/AML rules.

- Operational Efficiency: Fewer manual handoffs and streamlined data integration.

- Improved Customer Experience: Personalization powered by complete, up-to-date data.

Challenges and Best Practices

While NiFi is powerful, successful implementation requires planning:

- Latency Optimization: Tune NiFi flows and processor queues to meet low-latency needs.

- Compliance Readiness: Secure flows with encryption, tokenization, and RBAC.

- Flow Versioning: Use NiFi Registry to manage flow changes safely.

- Training: Upskill operations and data engineering teams to manage and scale flows.

Following these best practices ensures high availability, security, and performance in production environments.

Introducing Data Flow Manager: Simplifying NiFi Flow Management

As the complexity of NiFi environments grows, especially in regulated industries like banking, managing data pipelines manually through the NiFi UI can become overwhelming. That’s where Data Flow Manager (DFM) steps in.

Data Flow Manager is a purpose-built solution to:

- Automate the deployment and promotion of NiFi flows across development, staging, and production in minutes.

- Schedule and monitor flow deployments without direct access to the NiFi UI.

- Centrally manage controller services and environment variables across clusters.

- Maintain version control and rollback mechanisms.

- Generate NiFi flows with an AI-powered flow creation assistant.

- Analyze flow performance and structure.

Data Flow Manager acts as an orchestration layer over NiFi, helping banking IT teams reduce manual intervention, maintain compliance, and deploy secure, validated flows faster.

By combining NiFi with Data Flow Manager, banks can accelerate their journey toward real-time risk intelligence and truly unified customer data.

Conclusion

Modern banking thrives on speed, precision, and unified intelligence. Apache NiFi enables banks to break data silos, unify fragmented customer insights, and power real-time risk scoring – all without compromising on compliance or agility.

When coupled with Data Flow Manager, NiFi becomes even more powerful, offering automated flow promotions, streamlined governance, and environment-specific control. Together, they lay the foundation for a responsive, secure, and data-smart banking ecosystem.

![]()